Macro-level statistics and a wave of anecdotal evidence shows the recruitment market is moving into…

What does recession mean for recruitment in 2024?

It's official. We're in a recession. So is the year ahead going to be dire… or will we just carry on recruiting?

OK, like those ads for the well-known insurance comparison site, I’m confused. And, just like the wide many options available on said site (other sites are available), the range of opinions on how the recruitment market will develop in 2024 is, well, wide-ranging. Consider this: just last month, we learned that Hays had cut 1,150 roles over the last year, with over 650 of these going in the last quarter. Their CEO, Dirk Hahn was reported to have said there is a “clear slowdown” in the labour market.

Neil Carberry, Chief Exec of the REC believed that much of the blame for the job cuts across much of the business world can be attributed to high interest rates feeing through to consumer spending and thus impacting on the cost of doing business.

The REC monthly survey of jobs, based on returns from employment agencies, paints a similarly bleak picture. In Scotland, the December RBS/REC report on jobs “signalled a fresh decline in permanent staff appointments across Scotland … (with) the pace of reduction (being) the strongest since April, as growing economic uncertainty weighed on hiring decisions and discouraged workers from seeking new roles… Scottish recruitment firms recorded a fresh fall in permanent staff appointments during December, with declines now noted in four of the last five survey periods. The rate of decrease was the most pronounced since April and sharp. The reduction was linked by recruiters to heightened levels of economic uncertainty, which dampened employers’ and workers’ intentions to hire or seek out new roles.”

Increased global tension, mismanagement of many if not most of the world’s key economies, enormous dissatisfaction with politicians in many democracies and the continuing debate playing out over the future of work and different generations’ attitudes as to how it should best be done are all combining to make this a potentially more difficult (and dangerous) year than 2023. How then, to explain a report last month in the Daily Telegraph that PwC, having surveyed 4,000 Chief Execs worldwide, believes that much of the gloom is misplaced and that, in the UK at least, the authorities (they specify the Bank of England) are “too gloomy.” Interestingly, PwC believes that the political situation in the UK will not have any major impact on investment, probably because they know that a Labour victory in the General Election is baked in so business is planning accordingly.

The Telegraph doubtless has its own political line on this story. Nonetheless, you can see why I’m confused, given that nearly half of the UK CEOs surveyed said they plan to increase their workforce by at least 5% because they see increased optimism about the global economy. To make matters worse/better, Dutch bank ING (and others) are predicting that inflation will fall rapidly and far more quickly than previously expected (ING says it will be down to 1.5% by May), and it’s even more perplexing. Surely, reduced inflation, leading (hopefully, from the government’s perspective) to reduced wage demands and thus reduced costs for business will lead to more jobs and more hiring?

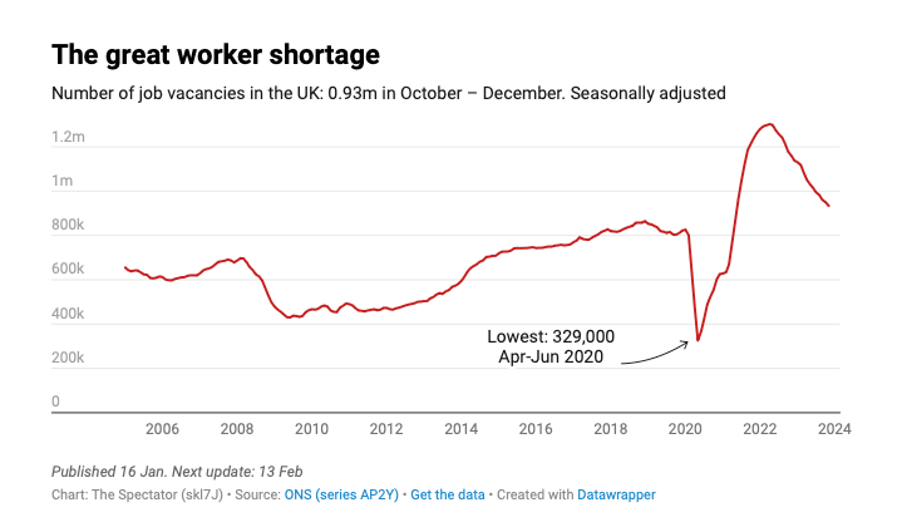

Not so fast… Despite this optimism, the number of job vacancies in the UK is dropping – as the chart below shows.

Who is right – PwC or the REC and the CEO of one of the biggest recruiters in the world?

The plain fact is that the last three months of 2023 saw the longest continuous fall on record in job vacancies. Moreover, all the data on the hiring side of the equation has to be seen against the numbers available and willing to take up any jobs on offer. Long-term sickness is playing an increasing role in skewing the unemployment figures and this is forecast to get much worse, with the benefits caseload possibly increasing by over 900 people per day for the next five years. PwC may be right in suggesting there is a bit to much gloom and despondency about, but it’s easy to see why the latter is perceived to be a more realistic basis on which to assess the UK economy and our job market in 2024. I suspect it’s going to be a year of hardship for many recruiters, with alternating good and bad news.

Being nimble and responsive is the way ahead. This means that recruiters should be reading and learning from the business/economic pages daily, speaking to their colleagues, clients and candidates even more than ever and ensuring that they can talk authoritatively about their own areas of specialism(s). The best will survive and even prosper, but as in any difficult times, others might struggle. Getting ahead of the AI curve and making sure that your own rec-tech is fit-for-purpose is also vital. Above all, know where you are now and where you want to be, but hang on to your hats – it’s going to be a challenging year for many.